Things about Pvm Accounting

Things about Pvm Accounting

Blog Article

Pvm Accounting Things To Know Before You Buy

Table of ContentsAbout Pvm AccountingOur Pvm Accounting DiariesRumored Buzz on Pvm AccountingExcitement About Pvm Accounting4 Easy Facts About Pvm Accounting DescribedHow Pvm Accounting can Save You Time, Stress, and Money.

Ensure that the audit procedure abides with the regulation. Apply required building accountancy standards and treatments to the recording and coverage of construction activity.Communicate with various financing agencies (i.e. Title Business, Escrow Firm) regarding the pay application procedure and requirements required for settlement. Help with executing and keeping internal economic controls and treatments.

The above declarations are intended to explain the basic nature and degree of job being carried out by people appointed to this classification. They are not to be understood as an extensive list of duties, obligations, and skills needed. Employees might be required to execute obligations outside of their normal duties periodically, as required.

Pvm Accounting - Questions

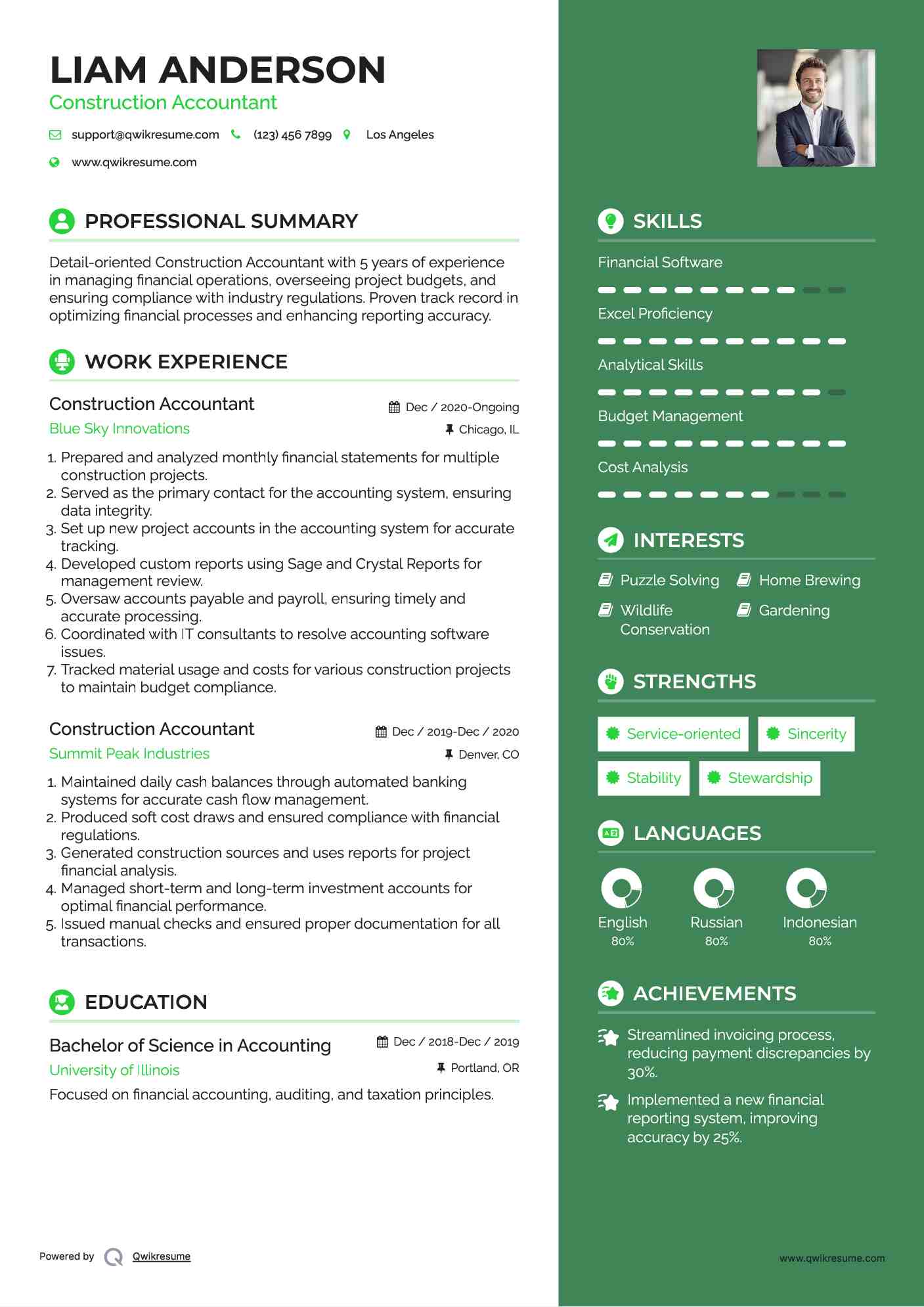

You will certainly help sustain the Accel group to guarantee delivery of successful in a timely manner, on budget, projects. Accel is looking for a Building and construction Accountant for the Chicago Workplace. The Construction Accountant does a variety of audit, insurance conformity, and task management. Works both independently and within specific divisions to keep financial documents and make sure that all records are kept present.

Principal duties include, however are not restricted to, handling all accounting functions of the firm in a prompt and exact fashion and supplying records and routines to the firm's CPA Company in the prep work of all financial declarations. Makes certain that all accounting procedures and features are taken care of properly. Liable for all monetary documents, payroll, financial and everyday procedure of the accountancy function.

Prepares bi-weekly trial equilibrium records. Functions with Project Managers to prepare and publish all regular monthly invoices. Procedures and problems all accounts payable and subcontractor settlements. Generates regular monthly wrap-ups for Employees Payment and General Responsibility insurance policy premiums. Generates regular monthly Task Expense to Date records and collaborating with PMs to integrate with Project Managers' budgets for each task.

Getting The Pvm Accounting To Work

Proficiency in Sage 300 Building and Genuine Estate (formerly Sage Timberline Office) and Procore building and construction management software an and also. https://www.wattpad.com/user/pvmaccount1ng. Need to additionally be competent in other computer software systems for the prep work of records, spread sheets and various other accounting evaluation that might be called for by monitoring. financial reports. Need to have strong business skills and ability to focus on

They are the financial custodians who make sure that building and construction jobs stay on budget plan, adhere to tax laws, and maintain economic transparency. Building and construction accounting professionals are not just number crunchers; they are critical companions in the building and construction procedure. Their key duty is to take care of the economic facets of building projects, guaranteeing that sources are assigned successfully and financial risks are lessened.

The Single Strategy To Use For Pvm Accounting

They work very closely with task managers to produce and check budgets, track expenditures, and forecast monetary needs. By preserving a limited grip on task financial resources, accountants assist avoid overspending and monetary problems. Budgeting is a keystone of effective building projects, and building accountants are crucial in this regard. They develop comprehensive spending plans that include all project costs, from products and labor to authorizations and insurance coverage.

Construction accountants are fluent in these guidelines and ensure that the task conforms with all tax demands. To succeed in the function of a building accountant, people need a solid academic structure in accountancy and money.

Additionally, certifications such as State-licensed accountant (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Sector Financial Professional (CCIFP) are highly concerned in the industry. Working as an accountant in the construction industry includes an unique collection of difficulties. Building and construction jobs typically entail tight deadlines, transforming regulations, and unforeseen expenditures. Accounting professionals should adjust swiftly to these obstacles to keep the task's monetary wellness undamaged.

The 7-Second Trick For Pvm Accounting

Ans: Building and construction accountants produce and keep track of budget plans, determining cost-saving chances and guaranteeing that the project stays within spending plan. Ans: Yes, building and construction accountants handle tax obligation compliance for building and construction projects.

Intro to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business have to make hard choices among numerous monetary options, like bidding on one project over one more, choosing financing for materials or tools, or setting a project's earnings margin. Building and construction is an infamously unstable sector with a high failing rate, slow-moving time to repayment, and inconsistent cash circulation.

Regular manufacturerConstruction company Process-based. Production includes duplicated Going Here procedures with conveniently recognizable costs. Project-based. Production requires various processes, materials, and equipment with varying expenses. Dealt with area. Production or manufacturing occurs in a solitary (or a number of) controlled locations. Decentralized. Each project occurs in a brand-new area with differing website conditions and distinct challenges.

Unknown Facts About Pvm Accounting

Constant usage of different specialty specialists and suppliers affects effectiveness and cash money flow. Payment arrives in complete or with regular payments for the complete contract amount. Some section of repayment might be withheld till job completion even when the service provider's work is completed.

Normal production and temporary contracts cause convenient capital cycles. Uneven. Retainage, slow-moving repayments, and high upfront prices result in long, uneven capital cycles - construction bookkeeping. While standard manufacturers have the advantage of controlled atmospheres and enhanced manufacturing processes, building and construction business have to regularly adjust to each brand-new project. Even rather repeatable projects require adjustments due to website conditions and various other factors.

Report this page